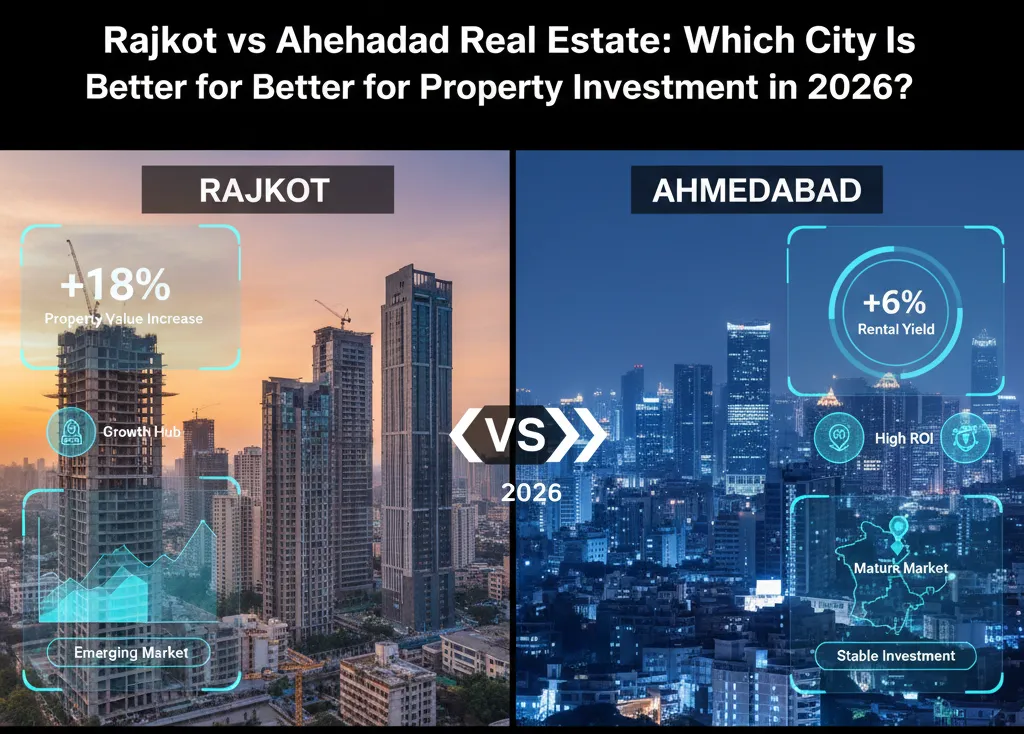

Gujarat continues to be one of India’s most trusted and growth-oriented real estate markets, and in 2026 the spotlight remains firmly on Ahmedabad and Rajkot. Both cities offer strong but very different property investment opportunities.

While Ahmedabad represents a mature, metro-driven real estate ecosystem, Rajkot is rapidly emerging as a high-potential Tier-2 investment destination. For investors, homebuyers, and private sector employees, choosing between Rajkot vs Ahmedabad in 2026 depends on budget, risk tolerance, rental expectations, and long-term appreciation goals.

City Snapshot: Ahmedabad vs Rajkot (2026)

Ahmedabad

Ahmedabad is Gujarat’s largest urban economy and a preferred destination for:

- Corporate offices and IT companies

- Large-scale residential townships

- Commercial and mixed-use developments

- Strong NRI and institutional investment

Rajkot

Rajkot is the economic backbone of Saurashtra and is known for:

- MSME and manufacturing dominance

- Affordable real estate pricing

- Infrastructure-led urban expansion

- Rising investor interest from outside Gujarat

Property Prices Comparison in 2026

Ahmedabad Property Prices

- Higher capital requirement

- Premium micro-markets remain expensive

- Price growth is steady but moderate

Rajkot Property Prices

- Much lower entry price

- Attractive for first-time and mid-budget investors

- Better scope for long-term appreciation

2026 Insight:

- Ahmedabad represents stability

- Rajkot offers growth opportunity

Residential Property: Ahmedabad vs Rajkot

Ahmedabad Residential Market (2026)

Ahmedabad shows strong demand for residential housing, especially:

- 2 BHK and 3 BHK apartments

- Rental homes for professionals and students

- Well-planned societies with lifestyle amenities

Advantages

- Easy resale liquidity

- Strong rental occupancy

- Developed social and civic infrastructure

Limitations

- High purchase cost

- Slower capital appreciation compared to Tier-2 cities

Rajkot Residential Market (2026)

Rajkot’s residential demand is driven by:

- Business families and local professionals

- Growing interest in premium apartments and villas

- New projects offering modern amenities at affordable prices

Advantages

- Lower entry investment

- Higher long-term appreciation potential

- Less market saturation

Limitations

- Rental demand varies by location

- Limited ultra-luxury inventory

Commercial Real Estate Comparison (2026)

Ahmedabad Commercial Market

Ahmedabad leads Gujarat in:

- IT parks and corporate offices

- Co-working spaces

- Malls and organized retail hubs

Why investors choose Ahmedabad

- Long-term lease security

- Reliable corporate tenants

- Consistent rental income

Rajkot Commercial Market

Rajkot’s commercial growth is driven by:

- MSMEs and trading businesses

- Office spaces and showrooms

- Growing warehousing and logistics demand

Why investors choose Rajkot

- Higher rental yield potential

- Affordable commercial assets

- Expanding local business activity

Rental Yield and ROI Comparison (2026)

Ahmedabad

- Entry cost: High

- Rental stability: Very high

- Rental yield: Moderate

- Appreciation potential: Steady

- Vacancy risk: Low

Rajkot

- Entry cost: Low

- Rental stability: Medium

- Rental yield: Moderate to high

- Appreciation potential: Strong

- Vacancy risk: Medium

2026 Verdict

- Ahmedabad suits income-focused investors

- Rajkot suits growth-focused investors

Infrastructure and Connectivity Impact

Ahmedabad Infrastructure

- Expanding metro rail network

- Expressways and ring roads

- International airport connectivity

- Smart city and urban upgrades

Rajkot Infrastructure

- Highway expansions connecting major cities

- Ring road development

- Smart city projects improving livability

- Urban planning and civic upgrades

Ahmedabad remains ahead overall, but Rajkot’s infrastructure momentum in 2026 is accelerating rapidly.

Who Should Invest Where in 2026?

Choose Ahmedabad If You Are:

- A salaried professional

- An NRI seeking safe returns

- A rental-income investor

- A commercial property investor

Choose Rajkot If You Are:

- A first-time property buyer

- A long-term investor

- A business owner

- Looking for affordable, high-growth assets

Risk Factors to Consider

Ahmedabad

- High capital investment required

- Limited scope for sharp price jumps

Rajkot

- Location selection is critical

- Resale may take time in non-prime areas

Smart due diligence is essential in both markets.

Real Estate Outlook: 2026 and Beyond

Ahmedabad Outlook

- Stable housing demand

- Strong rental ecosystem

- Limited but safe capital appreciation

Rajkot Outlook

- Rising interest from external investors

- Expansion in commercial real estate

- Strong appreciation potential over the next 5–10 years

Final Verdict: Rajkot vs Ahmedabad in 2026

There is no universal winner.

Ahmedabad is ideal for

- Stability

- Rental income

- Long-term safety

Rajkot is ideal for

- Affordable entry

- Higher appreciation

- Early-stage investment advantage

A smart and balanced investor may consider diversifying across both cities to optimize returns and reduce risk.

Subscribe Now For More articles.